Introduction

The finance jobs and industry is undergoing a significant transformation due to the integration of Artificial Intelligence (AI). This technological revolution is reshaping finance jobs, creating new opportunities while challenging traditional roles. As AI becomes more prevalent in financial institutions, it’s crucial for professionals to understand its impact on their careers and adapt accordingly.

AI’s Current Role in Finance

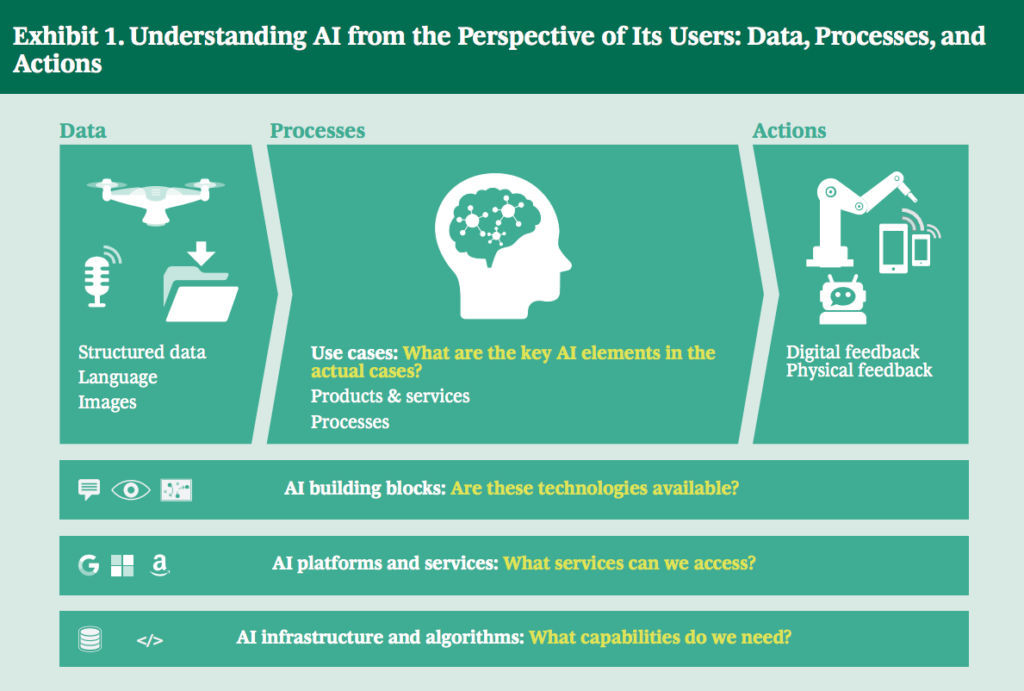

- Fraud Detection: AI algorithms analyze patterns to identify suspicious activities.

- Algorithmic Trading: AI-powered systems execute trades at optimal times and prices.

- Credit Scoring: Machine learning models assess creditworthiness more accurately.

- Customer Service: Chatbots and virtual assistants handle routine customer inquiries.

The Changing Landscape of Finance Jobs

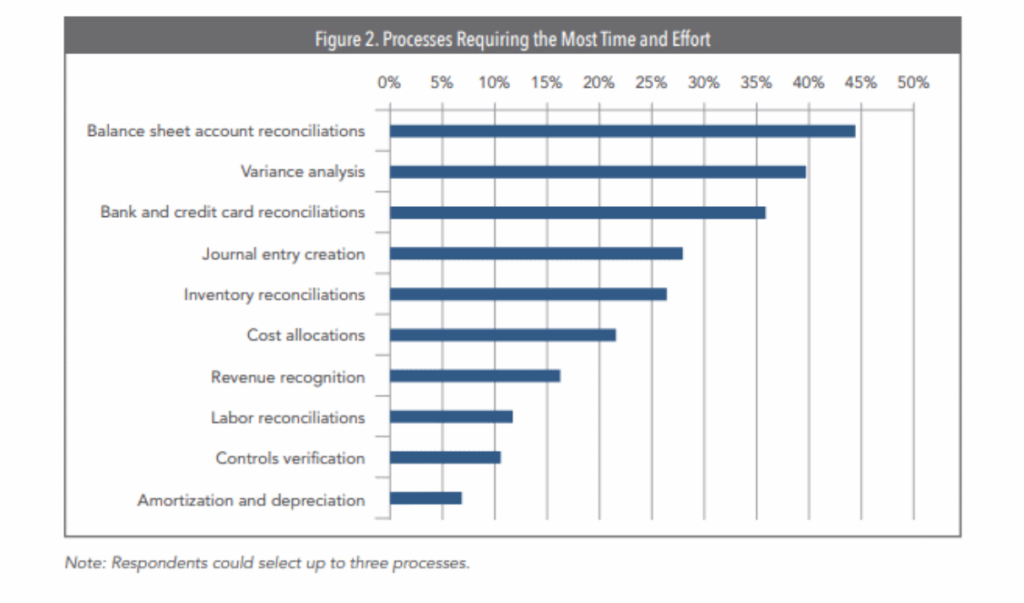

- Automation of Routine Tasks:

- Data entry and reconciliation

- Basic financial analysis

- Transaction processing

- Shift in Job Roles:

- From tactical to strategic positions

- Emphasis on data interpretation and decision-making

- Focus on financial planning and risk management

- New Skills Required:

- Data analysis and interpretation

- AI and machine learning proficiency

- Strategic thinking and problem-solving

- Adaptability to new technologies

Finance Jobs at Risk

- Data Analysts: AI can process large datasets more efficiently.

- Bookkeepers: Automated systems handle routine bookkeeping tasks.

- Entry-Level Positions: Junior analysts may face reduced demand.

- Basic Financial Reporting: AI can generate reports and perform simple analyses.

- Administrative Roles: Scheduling and data entry tasks are easily automated.

Finance Jobs Safe from AI

- Financial Advisors: Personalized guidance and emotional support remain crucial.

- Risk Managers: Complex decision-making requires human judgment.

- Compliance Officers: Ethical considerations and nuanced interpretations are essential.

- Investment Bankers: Relationship-building and negotiation skills are irreplaceable.

- Portfolio Managers: Qualitative analysis and client-specific strategies require human expertise.

The Future of Finance Careers

- Continuous Learning: Staying updated with AI advancements and financial trends.

- Upskilling: Developing proficiency in AI, data science, and advanced analytics.

- Soft Skills: Enhancing communication, leadership, and strategic thinking abilities.

- Ethical AI Management: Ensuring responsible and unbiased use of AI in finance.

- Hybrid Roles: Combining financial expertise with technological proficiency.

Preparing for an AI-Driven Finance Industry

- Pursue relevant certifications in AI and finance.

- Engage in ongoing professional development and training programs.

- Cultivate a growth mindset and embrace technological changes.

- Develop a strong understanding of AI ethics and governance.

- Focus on areas where human judgment and creativity are irreplaceable.

Conclusion

The integration of AI in finance is transforming the job market, creating both challenges and opportunities for professionals. While some traditional finance jobs may be at risk, new roles are emerging that require a combination of financial acumen and technological expertise. By staying adaptable, continuously learning, and focusing on uniquely human skills, finance professionals can navigate this changing landscape and thrive in their careers.

Related Videos

Back to Homepage

Try Claude