🔍 Introduction

1.ChatGPT can assist in understanding financial terms and concepts, making it easier for beginners to get started with stock market investing.

2.It can provide detailed information about specific stocks, including business models, SWOT analyses, and financial summaries.

3.ChatGPT can analyze investment opportunities by comparing historical data, financial statements, and other key metrics.

4.It can help conduct portfolio analysis, offering objective feedback on portfolio allocations based on risk tolerance and investment style.

5.ChatGPT can suggest stocks to invest in based on specific criteria, such as low debt levels or high growth potential.

6.While ChatGPT can provide valuable insights and analysis, it is not a substitute for professional financial advice and has limitations, such as lack of real-time data and potential inaccuracies.

📚 Understanding Financial Terms

Explanation: ChatGPT can explain how the stock market works and key financial concepts

Prompts: Users can ask questions like ‘What should I know about investing in the stock market?’ or ‘Teach me about stock market terminology.’

Goal: The aim is to become educated enough to make informed investment decisions.

Examples: Prompts such as ‘Explain price action’ or ‘How do you understand company financials?’ can be used.

Benefit: This helps users build a solid foundation in stock market investing.

📈 Researching Stocks

Business Model: ChatGPT can explain the business model of a company.

SWOT Analysis: It can perform a SWOT analysis to evaluate strengths, weaknesses, opportunities, and threats.

earnings calls: ChatGPT can summarize key points from earnings calls.

Financials: It can provide a breakdown of a company’s financials.

Risks: Users can ask about the risks a company faces.

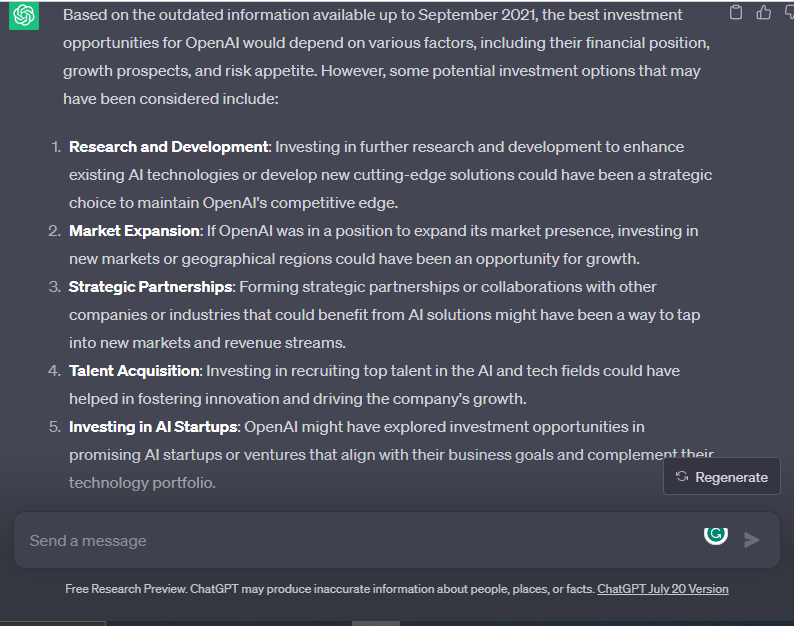

🐔 Analyzing Investment Opportunities

Comparison: ChatGPT can compare historical data of different stocks.

Financial Breakdown: It can break down financial statements and metrics.

Revenue: Users can ask about a company’s revenue.

Earnings Per Share: ChatGPT can analyze earnings per share.

net income: It can provide insights on net income.

👩 Conducting Portfolio Analysis

Objective Feedback: ChatGPT can provide objective feedback on portfolio allocations.

Risk Tolerance: It can determine if the portfolio allocation matches the user’s risk tolerance.

Investment Style: Users can ask for different allocations based on investment style (aggressive vs. passive).

Learning: This process helps users learn more about stock market investing.

Styles: ChatGPT can explain different investing styles.

📉 Stock Selection

Criteria: ChatGPT can suggest stocks based on specific criteria like low debt levels or high growth potential.

Direction: It can help users who are unsure where to start investing.

machine learning: Major funds use AI for market sentiment analysis and trend study.

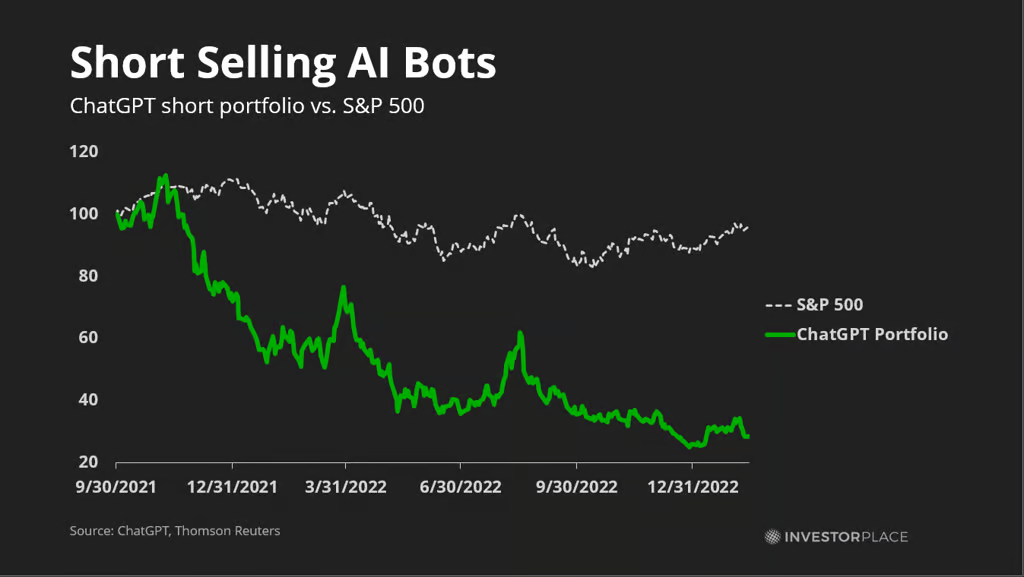

Limitations: ChatGPT is not yet capable of real-time stock picks.

Examples: Users can prompt ChatGPT to pick stocks based on criteria that make a company worth investing in.

⚠️ Limitations of ChatGPT

Real-Time Data: ChatGPT lacks access to real-time data, which is crucial for making timely investment decisions.

Economic Factors: It may not consider all variables, such as overall economic conditions and consumer spending habits.

Meme Stocks: ChatGPT might not account for sudden market movements driven by retail investors.

Rapid News Changes: The tool may not have the latest information due to rapidly changing news.

Professional Advice: ChatGPT should not replace professional financial advice.

📹 Related Videos

Back to Home